georgia ad valorem tax refund

Ad Valorem Vehicle Taxes. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year.

Can I Receive A Refund From The Irs For Overpaid Taxes San Jose Ca Tax Lawyer

If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax.

. PTS-R006-OD2020 Georgia County Ad Valorem Tax Digest Millage RatesPage 13 of 43. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. If itemized deductions are also.

The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and within the counties OCGA. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Related Agency Department of Revenue.

Check For The Latest Updates And Resources Throughout The Tax Season. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Ad Access Tax Forms. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Ad Access Tax Forms.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. This calculator can estimate the tax due when you buy a vehicle.

For example imagine you are purchasing a vehicle. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Request an additional six months to file your Georgia income tax return.

Multiply the vehicle price before trade-in or incentives by the sales tax fee. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia.

Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. The minimum is 725. The property taxes levied means the taxes charged against taxable property in this state.

This tax is based on the value of the vehicle. CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY ARTICLE 4 - COUNTY TAXATION 48-5-241 - Refund or credit of county taxes OCGA. Ad We are a no-risk contingency-based Professional Service.

Related Topics Ad Valorem Vehicle Taxes. The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such as signature pen or computer software program. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market value. For the answer to this question we consulted the Georgia Department of Revenue.

This ad valorem tax is deductible each year. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. Quick Links Georgia Tax Center.

Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax. In addition the State levies ad valorem tax each year in an amount which cannot exceed one-fourth of one mill 00025. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia. Complete Edit or Print Tax Forms Instantly.

We work with businesses of with 5-500 employees. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. Use Ad Valorem Tax Calculator.

Also refer to Regulation 560-3-2-27 Signature Requirements for Tax Returns. We Specialize Only In ERTC. Instead it appears to be a tax in the nature of a sales tax.

For vehicles purchased in or transferred to Georgia prior to 2012 there is still an ad valorem tax assessed annually and based on the value of the vehicle. The basis for ad valorem taxation is the fair market value of the property which is established January 1 of each year. No Refund - No Charge.

You will now pay this one-time. The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. The tax is levied on the assessed value of the property which by law is established at 40 of fair.

Georgia may have more current or accurate information. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

We make no warranties or guarantees about the accuracy completeness or adequacy of the information contained on this site or the. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia.

An Independent Contractor Who Receives 1099 Misc Forms Instead Of W 2s May Want A Second Pair Of Eyes On Their Returns Tax Write Offs Tax Prep Tax Preparation

How To Get A Full Tax Refund As An International Student In Us

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

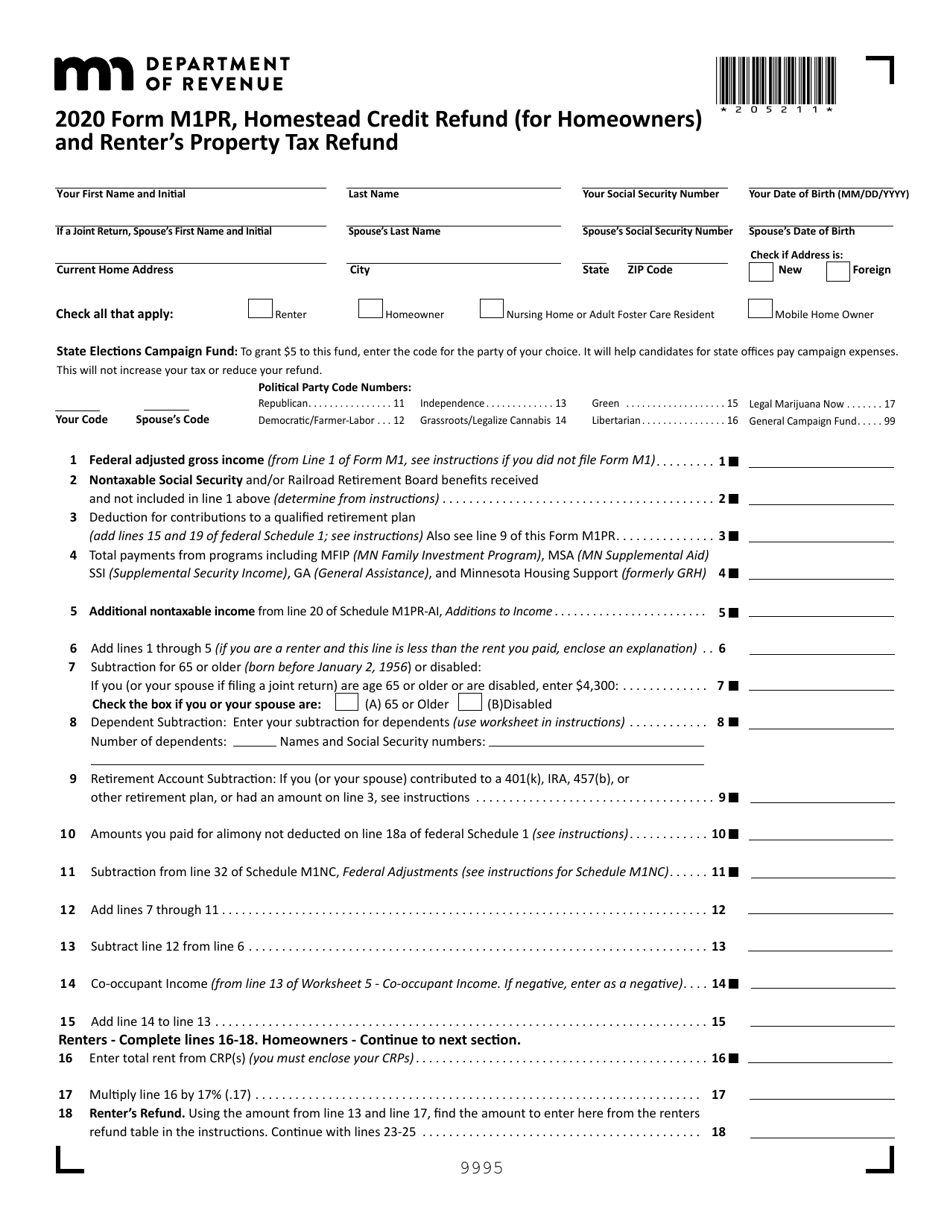

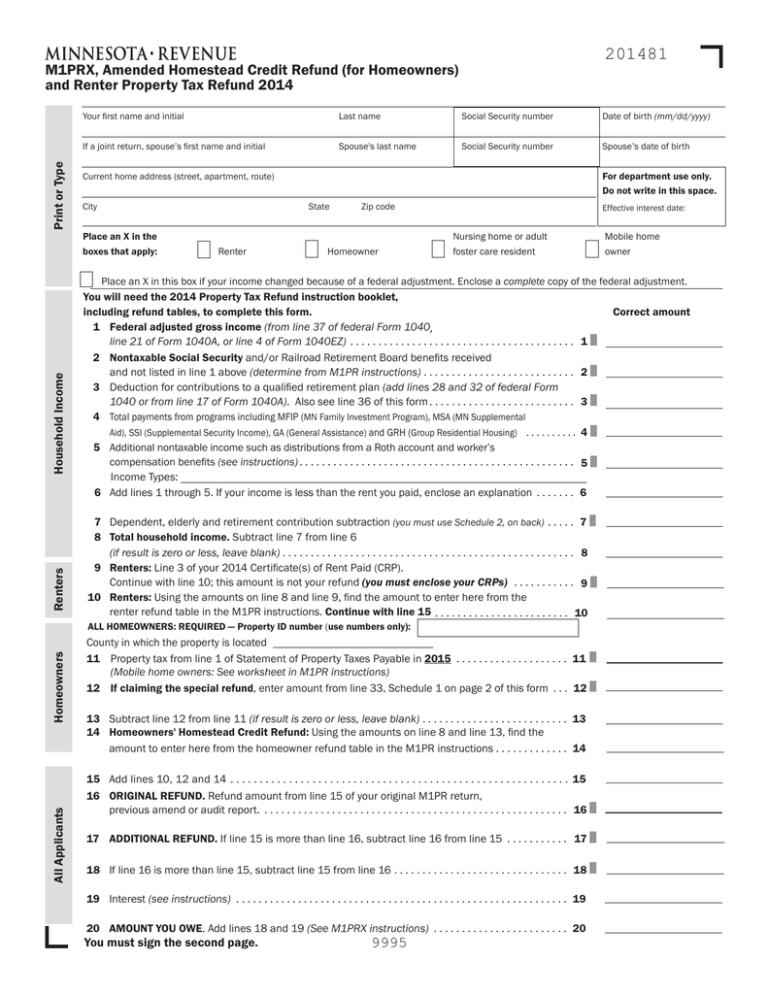

Form M1pr Download Fillable Pdf Or Fill Online Homestead Credit Refund For Homeowners And Renter S Property Tax Refund 2020 Minnesota Templateroller

Tax Refund Stock Photos Royalty Free Tax Refund Images Depositphotos

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

For Homeowners And Renter Property Tax Refund

H R Block Review 2022 Pros And Cons

Where S My State Refund Track Your Refund In Every State

Tax Planning Preparation Payroll Tax Services Sales Tax Services Personal Property Tax Services Personal And Business Tax Planning Preparation Services Pc Cpa Tax Experts

How To Get A Full Tax Refund As An International Student In Us

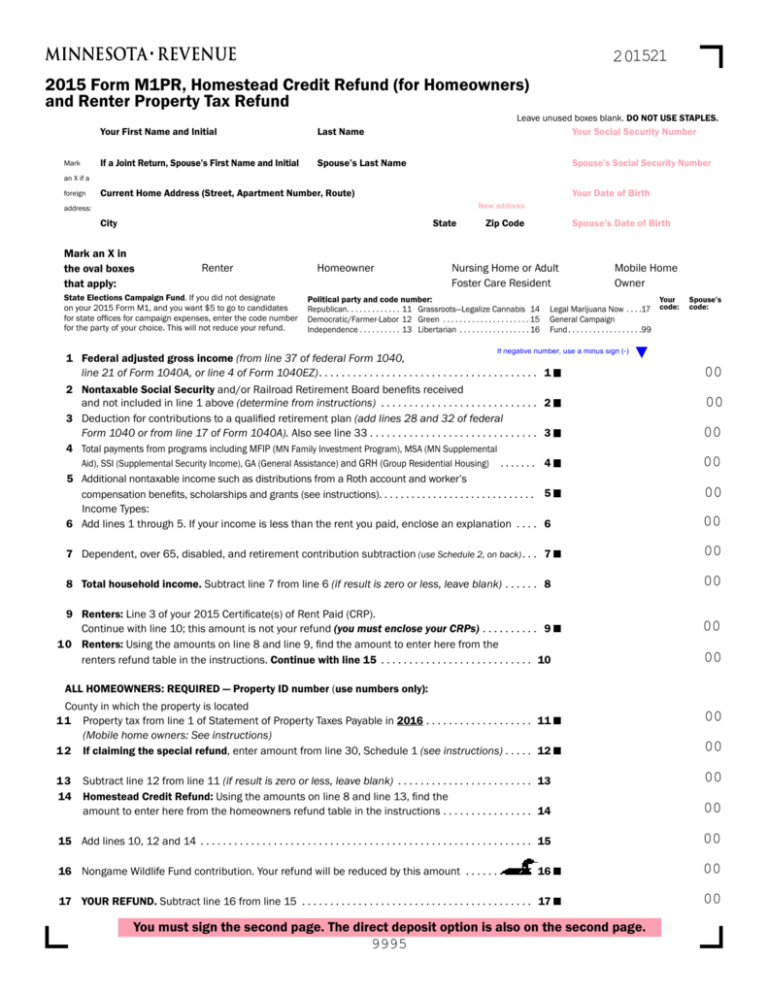

Form M1prx Fillable Amended Property Tax Refund

Deducting Property Taxes H R Block

Millions Of Low Income Americans Eligible For Tax Refund Boost This Year With The Earned Income Tax Credit Cbs News

Georgia Department Of Revenue To Begin Issuing Special One Time Tax Refunds The Georgia Virtue

Form M1pr Fillable Property Tax Refund

M1prx Amended Property Tax Refund Return

No Limt Tax Refunds Tucker Home Facebook

Why Your Tax Refund Is So Small And What To Do About It Money